Can “C” trade area opportunities make the grade?

Operators leverage location intelligence tools to weigh risks vs rewards in new markets

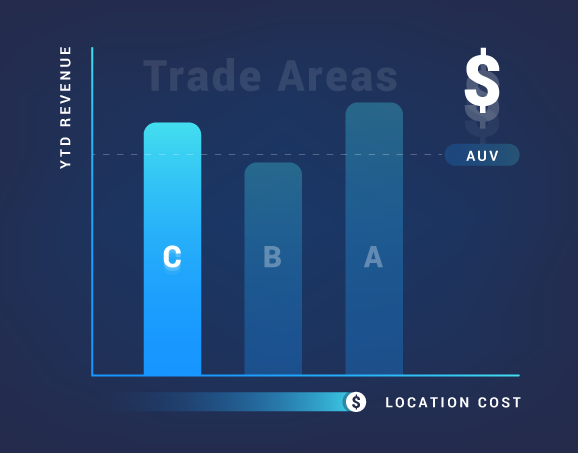

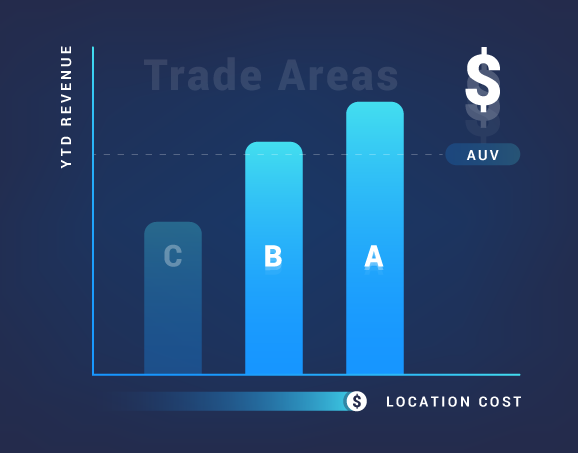

Chains often shy away from “C” trade areas in favor of A or B markets that often come with higher traffic and population density. But boots on the ground experience coupled with good location intelligence tools can help to uncover some hidden opportunities.

C-grade locations offer more – and often cheaper – real estate options, easier permitting and occasionally financial incentives for opening a business. Those factors can add up to better profit margins for operators. Yet C trade areas also can be a big gamble when a brand is making a move into a new or emerging market. The big question is whether the risk is worth the potential reward? How can a business know when the risk is worth taking, and when it’s better to walk away?

Opinions vary on how to define A, B and C trade areas. Oftentimes, “C” trade areas fall into the category of a rural community or a lower populated suburb. For example, a C rural market might have a population of 30,000 within a 5-mile radius, while a comparable suburb may draw from a trade area of 20,000 people within 2 miles. Other important characteristics for C-grade locations are good growth indicators related to population, traffic counts, commercial development and an increasing number of regional and national restaurant brands and other businesses entering the trade area.

One of the biggest benefits to locating in C-grade markets is that they are the A and B trade areas of the future and making an early move into an emerging market can help an operator establish a presence and gain market share ahead of competitors. Other key benefits operators can realize when building and operating in C trade areas include:

- Operators can often build smaller stores in smaller markets which helps to reduce construction costs.

- Labor costs can be lower, although skilled labor may be more limited.

- Shorter permitting and approval times equates to time and money savings with stores that can open weeks or even months ahead of counterparts in A or B markets.

- Greater opportunity to obtain incentives, such as reduced or deferred taxes, rebates and other state or local development incentives in towns eager for jobs and an improved tax base.

- Greater availability of land and/ or retail spaces, which allows for negotiating power in reduced pricing and rents.

Chains do need to weigh those rewards against the potential downside. One of the big risks of going into a C market is that a brand may be too early. Growth may be slow to materialize, or it may fall short of expectations. C areas tend to have more limited traffic generators, such as big employers or big box retail. So, if something happens to disrupt that traffic at one generator, such as was the case when the housing market bubble burst, then that single occurrence can have a bigger negative impact compared to an A or B market that has more traffic generators to rely on.

How can businesses optimize a C-grade site?

When considering the risk vs reward in developing stores in C trade areas, both corporate and franchise businesses need to pay close attention to industry standards for rent to sales ratios. For ground up QSR development, the general measuring stick that can help to guide sales is paying rent that equates to either 4-6% of sales for ground up, free-standing restaurants or 7-10% rent to sales for urban/ inline locations. In comparison, some QSRs are willing to be more aggressive in “A” locations where they know they can generate higher sales and will pay 10-12% for inline retail space in very dense city centers.

In my experience, having worked in store development for more than 14 years, historical sales often show there is a solid opportunity to build and open 1.25 to 1.75 new stores in C markets for every 1 densely populated suburban new store project. This being said, it also is important to conduct a deep dive analysis based on the specific concept and the development cost structure for stores in each segment – urban, suburban and rural – within a given region of the country.

Store development professionals can work hand-in-hand with site selection intelligence providers to better understand market dynamics within A, B and C trade areas. Market insight is critical when evaluating all types of locations. Especially for startup or emerging brands, A and B locations can pose just as much risk as a C location due to the high real estate costs, limited availability of land or retail space and high permitting costs associated with those preferred trade areas.

Established regional or national brands can more easily make the leap into C trade areas, because they can draw on brand identity and brand recognition. Oftentimes, they have bigger marketing budgets that help to better position a location for success even in a smaller market. However, gaining market insight from location intelligence providers such as SiteZeus is still a critical part of the process.

It’s exciting how technology has improved the process and can save time and money by eliminating sites that won’t work. For example, going out to a potential C-grade locations in Providence, Rhode Island or Springfield, Mass. used to take days or weeks to analyze. Now site selection intelligence firms can literally do that in a day and create a framework which real estate professionals can use when they are out in the field.

The development of C trade areas represents an opportunity to fuel additional growth for corporate and franchise businesses, but only when considered as part of an overall development plan and new store strategy. Those C market strategies need to account for proper analytics and trade area research to fully analyze the risks versus the potential rewards for those locations. When building new C area stores, it also is critical that impact modeling along with field assessment be done to prevent over saturation and erosion of sales to one or more existing stores and avoid jeopardizing the success of the new store.

Steve Fiedler, Restaurant Development Strategist & Growth Consultant has over 14 years of field work, experience in growth planning, market & trade area analysis, new store rollout strategies, site selection, dealmaking, contract negotiation, project management and new store development & opening for two iconic quick service (QSR) franchise restaurant brands. Steve has “boots on the ground” expertise, responsible for 200+ new restaurant openings in A, B and C-grade trade areas in market segments across all spectrums…rural, suburban and urban markets. Steve resides in Northeast CT with his wife, Lisa, and their two sons, Matthew and Zachary.

Steve is available for consulting projects and assignments to emerging or established corporate or franchise restaurant brands, short or long term.

Did you enjoy this post?

Give it a star rating to help us bring you great content!

Recommended Posts